how to claim california renter's credit

You must have a California Adjusted Gross Income or AGI of less than a. The property that youve rented for more than half a year mustnt be exempt from the California property tax during that year.

Browse Our Free 5 Day Notice To Pay Or Quit Template Templates Being A Landlord Quites

California tenants could get an expanded renters tax credit if Legislature passes bill backed by Democrats and Republicans.

. Have a family with children or help provide money for low-income college students. If it exceeds the number in Column B you qualify for a tax credit of as much as 1000. Yes if you meet all of the following qualifications.

The Nonrefundable Renters Credit is a personal income tax credit that is nonrefundable and can only be used to offset your tax liability meaning that if you dont owe any taxes this credit will NOT give you a refund. In order to qualify for the nonrefundable California renter credit here are the eligibility criteria you need to meet. Corporations provide equity to build the projects in return for the tax credits.

The qualifications for claiming the nonrefundable California Renters Credit include the following. You must be a California resident for the tax year youre claiming the renters credit. Nonresidents cannot claim.

There is good news for renters living and paying taxes in California. You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria. The maximum credit is limited to 2500 per minor child.

The other eligibility requirements are as follows. Renters Credit Nonrefundable. To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly.

Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the FTB with your tax return. You must have been a resident of California in the previous tax year. Hawaii renters who make less than 30000 per year and pay at least 1000 in rent for their.

Heres an in-depth California Renter Credit breakdown. Tax credits help reduce the amount of tax you may owe. How Do You Claim The CA Renter Credit.

File either a California form 540 complete line 31 540A line 19 or 540 2EZ line 13 tax return. To claim the renters credit for California all of the following criteria must be met. The rent relief program re-authorized in AB 832 pays 100 percent of unpaid rent.

The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident. You paid rent for a minimum of six months for your principal. If you paid rent for six months or more on your main home located in California you.

Your California adjusted gross income AGI is. If you already filed you would have to amend to claim but if you have not filed yet you can go back and add it to your return. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

TCAC allocates federal and state tax credits to the developers of these projects. To see if youre eligible first find your gross household income on the chart in Column A. To claim the renters credit for California all of the following criteria must be met.

If you pay rent for your housing. It seems like homeowners can get some pretty incredible tax breaks while renters are left out. You were a California resident for the entire year.

It can only lower the amount you owe to 0. The renters credit was suspended for the 1993 through 1997 tax years but was reinstated effective January 1 1998 for the 1998 and all future tax years. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively.

That is California is one of a handful of states that does permit renters to make a claim to reduce taxable income through a renters tax credit. Homeowners may be able to deduct some or all of their property taxes and mortgage interest and they can possibly exclude up to 250000 500000 if married of gain when selling their primary residence. Renters Tax Credit Applications for 2022 will be available for Maryland tenants on Feb.

Only the renter or lessee can claim a credit on property that is rented or leased as a homestead. In 2008 a 120 credit is. The credit is a flat amount and is not related to the amount of rent paid.

To qualify for the Californias Renters Credit you must meet the following. The maximum credit is limited to 2500 per minor child. O 40078 or less if your filing status is single or marriedRDP filing separately.

The california requirement for renters credit states the person must be living in their primary residence for more than half the year. 15 2022 and you can file online. What is California Renters Credit.

California allows a nonrefundable renters credit for certain individuals. To claim the ca renters credit. You may be eligible for one or more tax credits.

You were a resident of California for at least 6 full months during 2021. Gavin Newsom on June 28 2021 signed legislation that expands and extends the CA COVID-19 Rent Relief program designed to provide financial relief to renters and landlords with unpaid rental debt because of the pandemic. The Criteria to claim CA Renters Credit.

Your California adjusted gross income AGI is 45448 or less if your filing status is Single or Married Filing Separately or 90896 or less if you are Married Filing Jointly. Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes. 42932 or less if your filing status is single or marriedregistered domestic partner RDP filing separately.

Under California law qualified renters are allowed a nonrefundable personal income tax credit. If you qualify for the credit well calculate the amount of credit youre allowed. How to claim california renters credit Wednesday June 1 2022 Edit.

A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4. Renter Landlord COVID-19 Relief Program Extended. California allows a nonrefundable renters credit for certain individuals.

How you get it. California also has an earned income tax credit. You must meet all of the following to qualify.

Complete the worksheet in the California instructions to figure the credit. Updated - May 2022. The California Tax Credit Allocation Committee TCAC facilitates the investment of private capital into the development of affordable rental housing for low-income Californians.

While the amount of the credit is modest at 60 for an individual or 120 for a taxpayer with the head of household status or a. You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com.

Settlement Agreement Sample Check More At Https Nationalgriefawarenessday Com 39514 Settlemen Divorce Settlement Agreement Debt Settlement Divorce Settlement

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Safe Auto Insurance Agent Near Me

Irs Form 540 California Resident Income Tax Return

Geico Auto Insurance Worcester Ma

Eviction Notice Printable Eviction Notice Eviction Notice Letter Templates Free Being A Landlord

How California Renters Are Bracing For An Eviction Tsunami California Borrow Money Tsunami

Ten Advice That You Must Listen Before Embarking On Compare Car Insurance Compare Car Insurance

Compare Home Insurance Quotes And Rates 2021 Insurance Com Home Insurance Home Insurance Quotes Renters Insurance

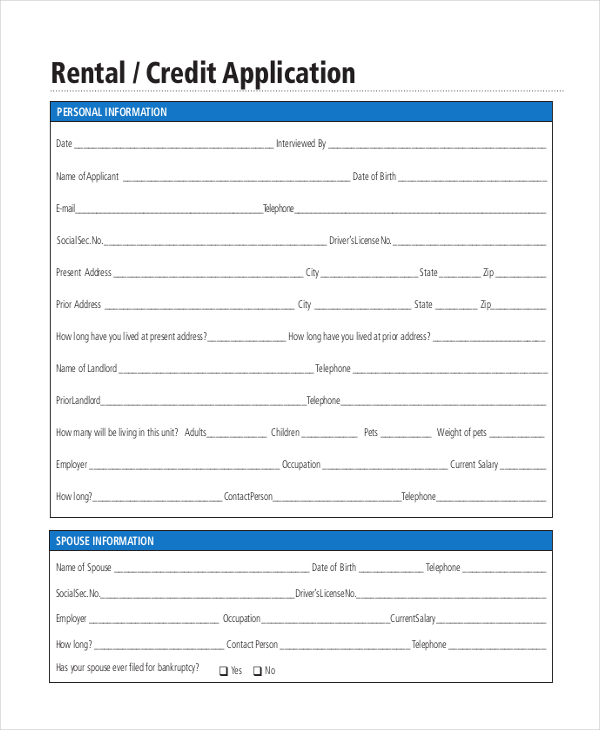

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

I Was Sent Someone Else S Rental Car Reservation Miles Quest Dollar Car Rental Car Rental Enterprise Rent A Car

11 States That Give Renters A Tax Credit

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com